PFC : Funding Pumped Storage Projects

By Rajiv Ranjan Jha | Director (Projects) | Power Finance Corporation Limited

Background

India has fulfilled its Nationally Determined Contribution (NDC) target of achieving about “40% of installed power capacity from non-fossil based energy resources by 2030”way ahead of time, and is progressively reaching 50% of installed capacity from non-fossil fuel sources. However, the intermittent nature of solar and wind power, and increased focus on grid stability has brought to forefront the significance of energy storage systems and has also given rise to need of innovative technologies such as Pumped Storage Projects and Battery Energy Storage Systems (BESS).

As per National Electricity Plan (NEP) 2023, Central Electricity Authority (CEA) has estimated requirement of energy storage capacity of 82.37 GWh in the year 2026-27, comprising of 47.65 GWh from PSP and 34.72 GWh from BESS. Thus, owing to their importance in ensuring grid stability and energy security as the share of Variable Renewable Energy (VRE) increases, PSPs are expected to play a significant role in building the required energy storage capacity.

Overview of PSP

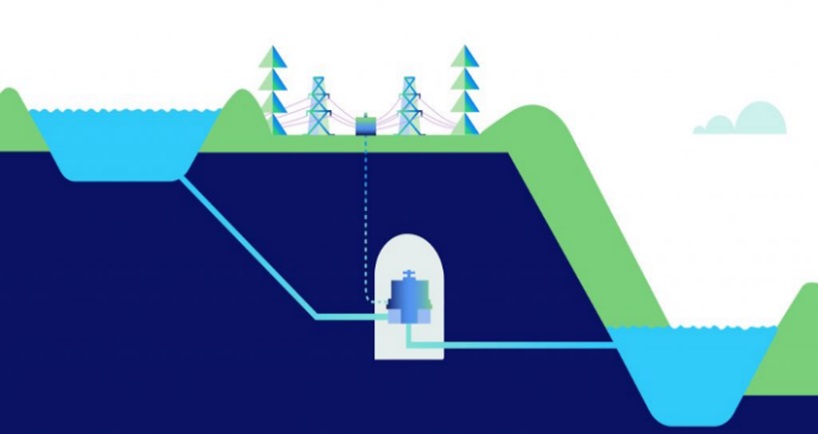

A Pumped Storage Project (PSP) is a type of hydroelectric energy storage that works by exchanging water between two reservoirs located at different elevations. It leverages the conversion of electric energy into potential energy. During periods of low electricity demand, surplus power (often from renewable sources) is used to pump water from a lower reservoir to an upper reservoir. When demand for electricity increases, the stored water is released from the upper reservoir, flowing downhill through turbines to generate electricity.

PSPs may be open-loop, i.e., project is always connected to a source of flowing water, or closed-loop, i.e., not connected continuously to a naturally flowing water source. Further, depending on the location of the reservoirs, PSPs can be categorized as:

On-stream PSPs: Both reservoirs are located on a river/ stream/nallah

Off-stream open-loop PSPs: Only one of the reservoirs is located on a river/stream/ nallah

Off-stream closed-loop PSPs: None of the reservoirs is located on a river/stream nallah

Difference between PSP and HEP

Pumped storage plants are technically similar to Hydro power plants and are best suited for meeting peak hour requirements. However, they differ from HEPs with respect to their need to pump water to upper reservoirs. This pumping activity consumes energy during off-peak hours. The pumping energy may be sourced from solar power during “shining hours”, wind power or may be provided by beneficiaries through grid (who have surplus power). While PSPs may be developed in close vicinity to existing hydro plants, there is also scope of development of standalone PSPs far from river beds.

Advantages of PSPs

Since PSPs store energy in the form of potential energy, it makes them cost-effective and sustainable solution for large-scale energy storage, in comparison to other conventional methods such as BESS that store energy chemically.

To set the perspective, the present cost of BESS is anticipated to be around Rs. 2.20-2.24cr/MWh, while that for PSPs may be estimated as Rs. 1cr/MWh.

In addition to cost-effectiveness, PSPs can store surplus energy generated by VRE sources during off-peak hours and release it when the demand is high. In fact, PSPs account for over 95% of installed global energy storage capacity. It is estimated that pumped storage hydro projects worldwide store upto 9000 GWh of electricity.

PSPs have a very long expected lifetime between 40-60 years. This is much more than any other energy storage technology presently available. While other energy storage systems such as BESS are generally designed for up to 4 hours of discharge, PSPs allow a longer discharge duration of more than 6hours. Further, PSPs allow a C-rate (which is inverse measure of the length of time over which system provides its maximum rated power) of C/20-C/6, whereas Li-ion battery has a C-rate of C/4-2C. Thus, PSPs can ensure a stable and reliable power supply, which is relatively immune to grid conditions, over a fairly long duration of time by balancing the variability of RE. Consequently, PSPs can prove helpful in facilitating reduction of reliance on conventional power generation.

It is anticipated that India would require 26.7 GW of PSPs and 47.2 GW of BESS (5hours) to integrate the RE capacity envisaged till 2032. However, since PSPs have multiple use cases worldwide, they are well-positioned to rapidly capture a significant share of the growing energy storage market in India. Though capital-intensive, their ability to offer long-term economic benefits facilitated by their long operational life and low operational costs, presents them as a favourable option to project developers.

In addition to their inherent benefits and suitable characteristics, it must be taken into consideration that India’s diverse geography offers several potential sites for PSP development. In fact, states like Maharashtra, Himachal Pradesh, Uttarakhand, and Karnataka have identified numerous locations for PSP projects.

NEP has identified current potential of on-river PSPs at 103 GW. Further, CEA has estimated a capacity addition of approximately 51 GW in pumped storage by 2031-32. In fact, as of September 2024, PSPs with a cumulative installed capacity of about 3.3 GW are already in operation. Also, PSPs with a cumulative capacity of about 4 GW are already under construction.

Government Guidelines for PSP in India

Recognizing the potential and critical role of PSPs in the energy mix of the country, the Government of India has introduced several supportive policies and guidelines. Large hydropower projects, including PSP, have been granted Renewable Energy status, enabling them to benefit from tax incentives and concessional financing.

To further facilitate development of PSPs, Ministry of Power (MoP) has issued ‘Guidelines to promote the development of Pumped Storage Projects’. CERC has also issued ‘Guidelines for Formulation of Detailed Project Reports for Pumped Storage Schemes’ and ‘Guidelines for Acceptance, Examination and Concurrence of Detailed Project Reports for Pumped Storage Schemes’ as efforts to simplify the process.

These efforts are paving the way for increased investment in PSP, supporting India’s ambitious goal of achieving 500 GW of RE capacity by 2030.

Role of PFC

PFC has always been at the forefront of championing the financing of projects that have the potential of benefitting Indian power sector. Our expertise in funding power projects helped us realize the potential of PSPs at a very early stage, making us the first movers in the area of financing such projects. In fact, our credibility in the power sector financing also rendered us as a financing partner of choice for developers establishing India’s maiden private sector PSP.

To develop the requisite energy storage capacity, completion of about 7,900 MW of PSPs per annum is necessary. NEP has estimated a fund requirement of approximately INR 54,203 cr. for PSPs by 2026-27. Understanding this market potential and Indian growth and development scenario, along with India’s commitment to achieve Net Zero target by 2070, PFC is playing a significant role in facilitating the development of favourable ecosystem for development of PSPs. PFC also carried out a study on “Financial Viability and tariff optimization of Pumped Storage Plants (PSP)” which was utilized by Govt. authorities while framing requisite guidelines for development of PSPs.

Further, it must be highlighted that commercial viability of PSPs will be largely dependent on availability of input power at affordable rates. As India’s leading financial institution dedicated to power sector, PFC has facilitated the development of critical power infrastructure projects across the country and has also supported one-fourth of its renewable energy installed capacity. In the long run, this would act as an enabler for profitable operation of PSPs.

In a nut shell, it is noteworthy that India has emerged as one of the fastest-growing RE markets globally, with PSP playing a pivotal role in addressing the storage and balancing needs of this expanding renewable portfolio. With favourable government policies, financial incentives, and increasing global interest in sustainable infrastructure, PSP projects are attracting both domestic and international investors, and PFC is fully committed to support investment in Pumped Storage Projects by financing such projects, so as to Fund a Brighter, Cleaner, Greener and More Sustainable Tomorrow for India.

Co-Authored by V. B. Hemanth

DGM (Projects) | Power Finance Corporation Limited

(Shilpa Bichitra | Special Edition | 2024)

Categories

-

Agriculture & Rural Development11

-

Banking & Insurance4

-

Coal & Mines5

-

Defence & Defence Production5

-

Engineering & Technology3

-

Environment & Pollution1

-

Export & Import1

-

Housing & Urban Development1

-

Human Resources & CSR Initiatives2

-

Iron & Steel3

-

Logistic & Warehousing2

-

Micro, Small & Medium Enterprise3

-

Petroleum & Natural Gas6

-

Post & Telecommunication2

-

Power & Energy3

-

Tourism & Leisure2